Union Budget 2025-26: Which Tax Regime is Beneficial?

The 2025 Union Budget has been lauded for its focus on the middle class, particularly salaried individuals. The new tax regime under Budget 2025 is designed to simplify taxation and benefit salaried individuals with higher tax-free limits and lower tax rates. By optimizing salary structures, leveraging tax-free investments, and managing TDS smartly, salaried persons can maximize their savings while reducing tax liabilities.

Key Benefits for Salaried Persons

The 2025 Budget focuses on simplifying taxation and enhancing relief for salaried taxpayers through higher exemptions, revised tax slabs, and increased deductions.

1. Increased Tax Exemption Limit

One of the most notable changes is the increase in the income tax exemption limit. Individuals earning up to ₹12 lakh annually are now exempt from paying income tax, up from the previous threshold of ₹7 lakh. For salaried taxpayers, this limit extends to ₹12.75 lakh, considering the standard deduction of ₹75,000.

2.Revised Income Tax Slabs

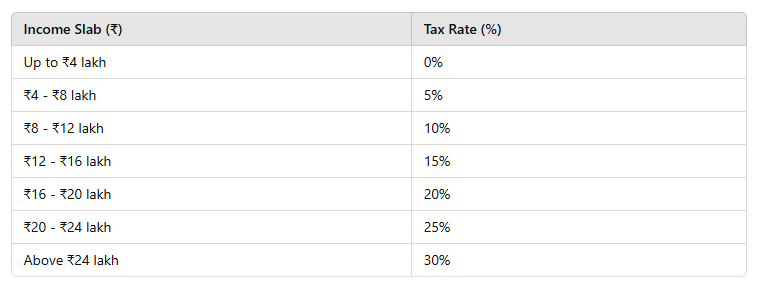

The budget introduced new income tax slabs to ensure a more progressive taxation system:

The new slabs lower the tax burden for most salaried individuals, making tax planning simpler than in the old regime. These adjustments aim to reduce the tax liability across various income brackets, thereby increasing disposable income.

3. Standard Deduction for Salaried Employees

The standard deduction has been increased to ₹75,000 in previous budget, providing additional relief to salaried individuals. This measure simplifies the tax filing process and offers straightforward benefits without the need for specific investment declarations.

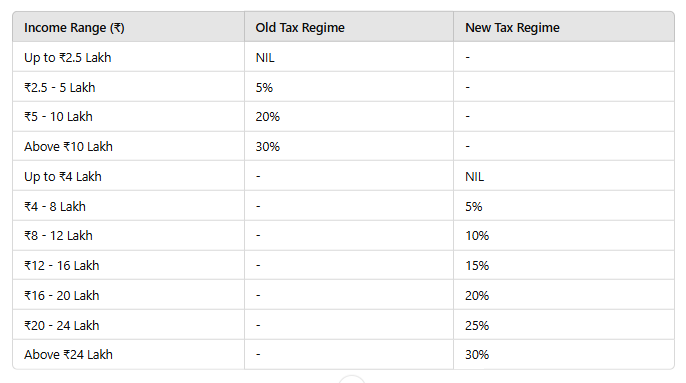

4. Tax Slab Comparison: Old vs. New Tax Regime (Budget 2025)

5. Which Tax Regime is More Beneficial?

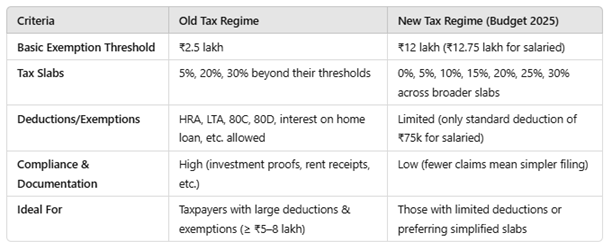

Old vs. New Tax Regime (Budget 2025) – Key Differences

- For those earning up to ₹12 lakh, the new tax regime is better, as there is zero tax liability.

- For those earning ₹15-25 lakh or above, the best choice depends on deductions:

- If deductions are less than ₹7-8 lakh, go for the new tax regime.

- If deductions are more than ₹8 lakh, the old tax regime is better.

6. Additional Considerations

- Flexibility: Salaried employees can switch between regimes annually, allowing adjustments based on financial changes.

- No Deductions in New Regime: The new regime does not allow deductions under Section 80C, 80D, or HRA, which may impact taxpayers relying on these benefits.

- Simplicity: The new regime eliminates the need to track investments for deductions, making tax filing easier.

Calculate Both Scenarios:

The best way to decide is to compute your approximate tax under both regimes using your actual income, possible deductions, and the relevant slab rates. Whichever yields a lower overall liability is generally the better choice.

Conclusion:

A Positive Outlook for Salaried Individuals

The Union Budget 2025-26 has introduced comprehensive measures to benefit salaried individuals, reflecting the government’s commitment to supporting the middle class. By increasing the tax exemption limit, revising tax slabs, and enhancing deductions, the budget aims to improve the financial well-being of salaried persons. These initiatives are expected to stimulate consumption and contribute to sustained economic growth.

Frequently Asked Questions (FAQs)

1.What is the new income tax exemption limit for salaried individuals in Budget 2025?

The exemption limit has been raised to ₹12 lakh, and up to ₹12.75 lakh for salaried taxpayers considering the standard deduction.

2. How has the standard deduction changed in the 2025 budget?

The standard deduction for salaried employees has been increased to ₹75,000.

3. How do these tax changes benefit the middle class?

The reforms reduce tax liabilities, increasing disposable income and enabling higher consumption and savings.

4. What relief has been provided to homeowners in Budget 2025?

Taxpayers can now classify the annual value of two self-occupied properties as zero, exempting them from paying taxes on assumed rental income.

5. Is the old tax regime still applicable after Budget 2025?

Yes, taxpayers can choose between the old and new tax regimes based on their

6. Any changes in the Old tax regime in budget 2025?

No, In the Budget 2025, the old tax regime remained unchanged. The government focused on enhancing the new tax regime by introducing lower tax rates and increasing the basic exemption limit to ₹4 lakh.

7. Can I switch between the old and new tax regimes every year?

Yes, salaried employees can choose between the old and new tax regimes every financial year.

8. What happens to my Section 80C deductions in the new tax regime?

The new tax regime does not allow deductions under 80C, 80D, or HRA, so these benefits cannot be claimed.

9. How can I decide which tax regime is better for me?

Compare your tax liability under both regimes using an Income Tax Calculator to see which one offers more savings or consult to tax expert.

10. Is the new tax regime mandatory?

No, taxpayers can choose between the old and new tax regimes based on their financial situation.

Comments

No comment yet.